How to Boost Your 2023 Plan with Power-Packed Compensation Strategies

Powerful Compensation Strategies for 2023

Is 2023 the Year to Upgrade Your Compensation Strategies? Absolutely.

As 2023 progresses, employers are experiencing recruiting fatigue and facing low employee engagement scores. Adding to the pressure are employee preference for flexible work arrangements and management reviewing their policies to entice employees to return to the office. In addition, new pay transparency requirements in various states, including NY, CA, and Washington, have promoted employers to update their recruiting policies with greater urgency for up-to-date salary information so they can make informed offers to prospective candidates. To help organizations meet these challenges, Blue Whale Compensation has compiled a series of compensation strategies that can help companies best manage their labor and talent needs.

We are living through a historical shift in the workplace with rising wages and inflation. At no other time in recent history has compensation taken a front seat as a means companies can use to retain, engage, and attract new talent. A compensation strategy, however, should not be confused with solely giving employees aggressive increases. Unwarranted increases with no other plan are likely to make issues worse.

The plan needs to be based on a comprehensive analysis of budgets, labor needs, current and future talent needs, and basic compensation planning.

A Market Analysis is a Must

Carefully examine market levels and set appropriate salary benchmarks. Based on that information, consider market adjustments. Market adjustments should aligned to market trends, inflation, employee performance, market position, and budget. With inflation eating away any substantial wage gains, forecasting reports indicate that most employers will grant increases above those in 2022. In 2023, pay increases ranged from 4.5% to 5.7%. Furthermore, a preliminary analysis of Blue Whale clients’ plans suggests that a majority of them are inclined to offer a one-time bonus to address the substantial inflation witnessed over the past 18 months.

Merit-Base and Market-Driven Increases based on Performance

Combine your performance management information with an employee’s market position if you have ranges and midpoints. Using a merit-driven grid, you can justify larger, above-average increases to high-performing, underpaid employees. Conversely, the matrix helps you develop a policy to slow down salaries that are way above market midpoints.

Is setting merit based on employee performance and market position tricky? Blue Whale can help. We provide BlueComp, a freeware app that helps organizations manage their compensation program, including merit-based pay. For more information, click here to view how BlueComp can help you manage your compensation program.

Identify Employees at Risk

Mine your employee data and identify the employee population that is most at risk of leaving your company. Use your compa-ratios! Employees with the lowest compa-ratios are twice as likely to be looking for employment. Review your employee population via existing interview data: what departments, units, or types of employees are leaving at a faster pace, and what trends can you derive from their exit interviews?

Closely examine your labor stats and compare them to specific benchmarks. For example, voluntary turnover rates are between 10% and 17%. Are your higher or lower? Employee tenure is another key barometer to measure at-risk groups. Employees who have more than four years with a company as twice as likely to stay with the company for another three to four years. Employees who have less than two years of experience are twice as likely to be looking for another job. In addition to critical stats, check data from your employee opinion or engagement surveys. They often contain valuable information that can help you identify at-risk employee populations.

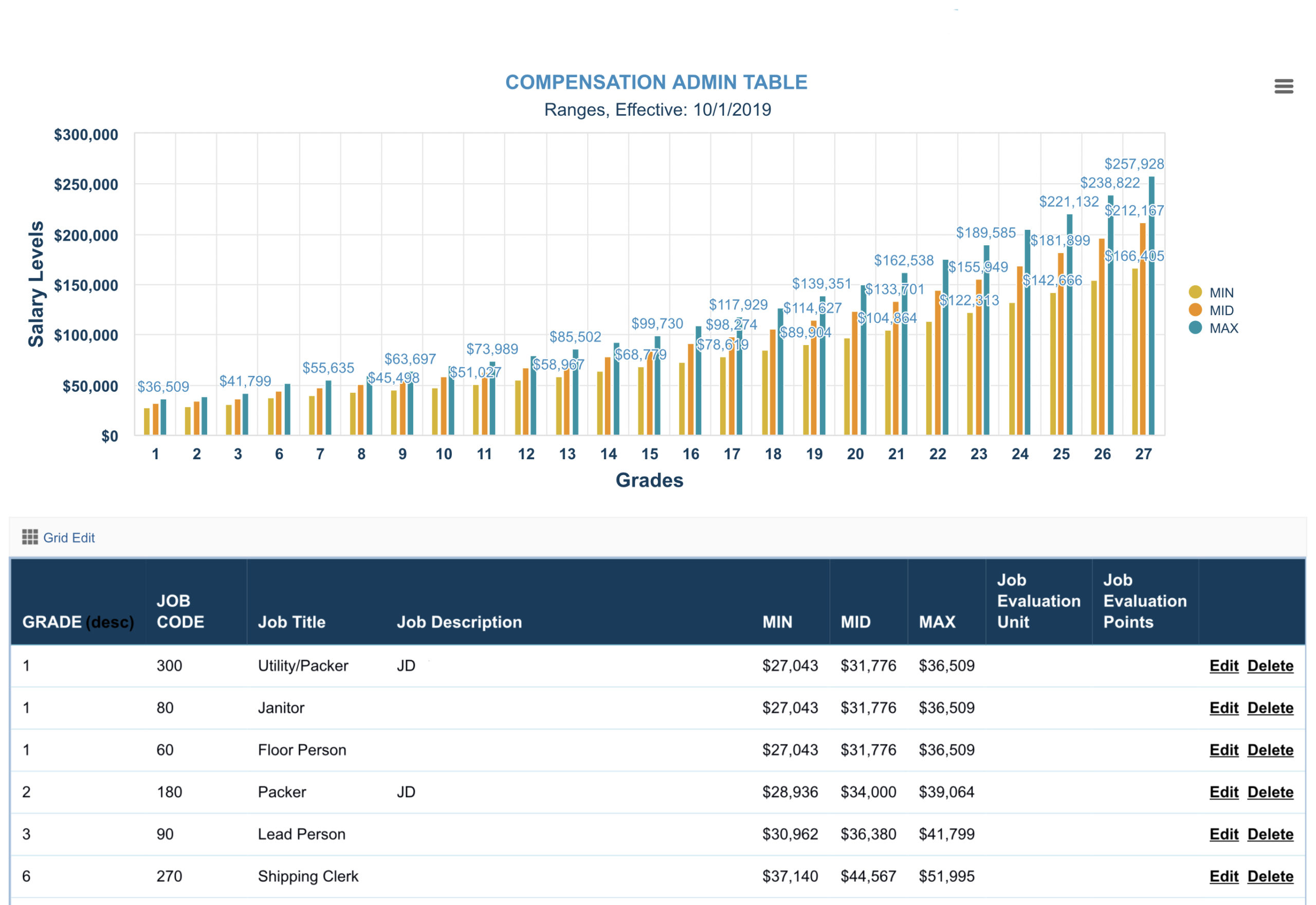

Implement a Basic Compensation Plan with Guidelines, Grades, and Ranges

Unlike the rapid wage movement that employers experienced in 2022, pay increases in 2023 have slowed down. Your plan must be appropriately aligned with current market conditions. The plan must include grades based on job leveling; ranges reflecting reasonable hiring salaries; policies addressing promotions and demotions; and, most importantly, a basic outline of your company’s compensation philosophy.

Upgrade Your Performance Management System

Over the last few years, AI-driven solutions have come into the marketplace with innovative technologies that have simplified the often complex and disliked world of performance management tools. Many tools exist to offset companies’ great challenges with their existing program. Most app-based solutions tend to be affordable, flexible, and easy to deploy.

Consider Bonus for High Paid Employees, Not Increases

For high-paying employees versus additional salary, examine the market, and follow the following strategic budget: For employees over the midpoint, offer them a one-time bonus; for employees under the midpoint, add to their base. Over time, this strategy will keep your costs even with the market, and you can target at-risk employees and perhaps even keep them.

Selling your Plan

The biggest mistake companies make when resetting a compensation program is focusing their message on how the new plan will make the company more productive, efficient, and ahead of the curb. Instead, The message should focus on giving the employees the information they need to trust the process and the overall plan. This effort requires a significant public relations strategy that cultivates the organization’s needs for the immediate future and long-term success.

Let’s Start the Conversation

Blue Whale offers a full range of compensation services to help you achieve your business goals. Whether you’re looking to design a new compensation plan, analyze your current program, or stay up-to-date with the latest trends, we have the expertise and resources to meet your needs. Contact us to learn more about our compensation services and how we can help you take your program to the next level. Let’s start the conversation!